Is a digital wallet the new microbank? Can a non-banking financial company (NBFC) now credit the loan amount directly into a wallet, disintermediating a bank completely? Can a wallet be used to set up standing instructions for EMIs? Can cash be withdrawn from and deposited into wallets using ATMs run by non-banks? Should banks worry?

If the recent announcements by the RBI, allowing Prepaid Payment Instruments' customers with full KYC to avail limited banking solutions are any indication, the answer to all the above could soon be ‘yes’.

Over the last decade, since its introduction in India, the digital wallet payment system has not only captured a significant market share but also completely revolutionised the payment system. By 2018, almost 8% of the Indian population was using digital wallets for payments.

The use of prepaid wallets was further propelled with the launch of UPI, which allowed an open architecture payment system.

The RBI’s announcements, when viewed in totality, are indeed expected to have a significant impact on the country's payments system. The interoperability of wallets would mean a customer can transfer money from one wallet to another, or to a bank account. Effectively, mobile wallets will be able to transfer and receive funds like bank accounts.

Further, enhancing the current limit of outstanding balance in a wallet from Rs 1 lakh to Rs 2 lakh would help in increasing the throughput of transactions through the wallet and boost their usage.

Permitting non-bank payment system operators - like prepaid payment instrument (PPI) issuers, card networks, white-label ATM operators and TReDS - to take direct membership of centralised payment systems, will enable wallet customers to send or receive funds through direct electronic transfers to a bank or to another wallet. This would enhance the reach of digital financial services like RTGS and NEFT to all user segments, including in Tier 3 and 4 cities.

Allowing cash withdrawals from full KYC wallets combined with white-label ATMs and interoperability will boost migration to full-KYC wallets.

The proposed changes will bring mobile wallets almost at par with banks for most practical purposes. Profiles such as students need not open a bank account – they could get funding from the bank account of their parents and use the wallet for all kinds of electronic payments.

With wallets joining RTGS and NEFT payment systems, functions like fee payment, house-rent payment can be performed without making bank transfers. On the lending side, an NBFC may consider setting up its own wallet and disburse the loan in the customer’s wallet account maintained with the same NBFC.

The customer can use the money or withdraw cash as and when required. In a way, a wallet could be almost like opening a saving account with the NBFC.

Going forward, wallets have the potential to serve as a front-end interface for banking services while traditional banks would continue focusing on core activities of underwriting in the backend. In effect, customers will have the option of choosing a financial service provider without changing their bank account – for instance, a bank account holder may use Paytm for customer service while retaining his or her bank account in the backend.

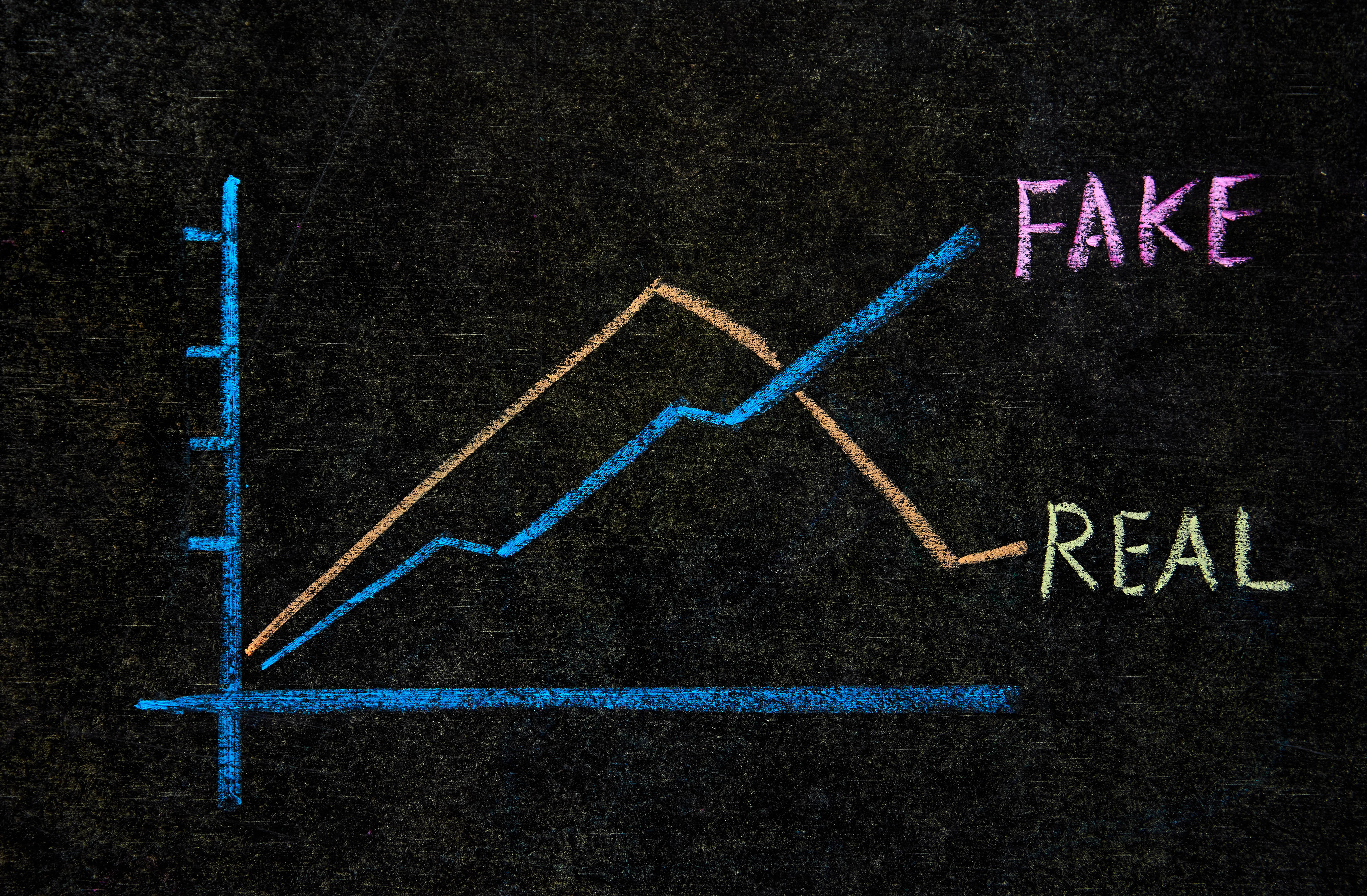

However, considering that full KYC would be required for wallets to provide these services, the regulatory arbitrage that had propelled the growth of mobile wallets would go away. If mobile wallets are successful in building a customer base with full KYC accounts, this has the potential to make banking services interoperable for wallet customers.

And as I have written in my previous columns, the banking regulator should now mull over introducing portable banking solutions, enabling the customer to seamlessly move from one service provider (a bank and now even a wallet) to another, very much like in mobile telephony. These announcements could well set the stage for that loftier goal.

Read more at:

Company

About Us

Blog

Services

Send Money

Reload Phones

Pay Bills

Gift Cards

Track Transfers

Terms and Conditions

Anti-money laundering policies

Privacy Notice

OFAC Sanctions Compliance

Licenses

©2025 Cashship. All rights reserved

©2025 Cashship. All rights reserved