OFAC Sanctions Compliance

OFAC Sanctions Compliance

CASHSHIP

LEGAL PROVISIONS ON NON-COMPLIANCE WITH REMITTANCE HOUSES' REGULATIONS IN THE REPUBLIC OF PANAMA

Through Law 48 of June 23, 2003, national legislation established the regulatory framework for remittance houses' operations. For such purposes, it was also accompanied by chapters concerning supervision, revocation of licenses, fines, breaches, and sanctions, which we proceed to describe below:

“…

Chapter IV Auditing

Article 22. Each year the Directorate of Financial Companies of the Ministry of Commerce and Industries shall conduct at least one audit of each Money Remittance House to determine its financial situation and whether, in the course of its operations, it has complied with the provisions of this Law and the existing laws on the prevention of money laundering.

Article 23. Without prejudice to the provisions of the preceding article, the Directorate of Financial Companies of the Ministry of Commerce and Industries, through officials duly authorized in writing, is empowered to request and obtain from the Money Remittance Houses specific accounting, statistical and financial information, provided that there are well-founded reasons for doing so. The Directorate shall take the corresponding sanctioning actions in non- compliance with this article.

Article 24. Any refusal by the Money Remittance Houses to submit to the inspection referred to in the preceding article, and the Directorate of Financial Companies shall sanction the submission of false reports or documents following the provisions of Article 30 without prejudice to the corresponding criminal sanction.

Chapter V - Procedure for Revocation of Authorizations and Imposition of Fines

Article 25. Through the Directorate of Financial Companies, the Ministry of Commerce and Industries shall investigate, ex officio or following a complaint from any person or authority, the cases in which it is presumed or alleged that any of the provisions of this Law have been violated. If they find cause to do so, they shall issue a reasoned resolution providing for the appropriate action.

Article 26. By the preceding article, the resolutions issued by the Directorate of Financial Companies shall admit an Appeal for Reconsideration and appeal before the Minister of Commerce and Industries, following the procedure established in Law No. 38 of 2000.

Article 27. When it is appropriate to revoke the authorization to operate a Money Remittance House, once the corresponding resolution has been executed, an authenticated copy thereof shall be sent to the General Directorate of Domestic Commerce of the Ministry of Commerce and Industries to cancel the authorization to carry out the activity. The related communications shall be made to the Ministry of Economy and Finance and the respective Municipality.

Article 28. The legal representative of a Money Remittance House that is duly summoned to appear before the Directorate of Financial Companies of the Ministry of Commerce and Industries fails to do so, without just cause, shall be in contempt of court, and the company shall be fined one hundred balboas (B/.100.00) the first time and one hundred and fifty balboas (B/.150.00) the second time. If he does not appear at the third summons, his failure to appear shall produce a presumption against the company concerning the facts that gave rise to the summons, and the resolution referred to in Article 25 of this Law shall be issued immediately.

Chapter VI Breaches and Penalties

Article 29. Breaches committed by Money Remittance Houses, duly authorized by this Law, shall be sanctioned by the Directorate of Financial Companies of the Ministry of Commerce and Industries in the following manner:

1. Written warning in case of the first breach.

2. Fine of one thousand balboas (B/.1000.00) and fifty thousand balboas (B/.50.000.00) in case of recidivism in the same breach.

3. Cancellation of the authorization for the exercise of Money Remittance Houses in case of committing the same breach for the third time.

If the breach is committed with the knowledge of a public servant, they will be immediately removed from their position without prejudice to any criminal liability that may be applicable.

If the breach is committed in violation of the provisions of Law 42 of 2000 on money laundering, the sanctions set forth therein shall be applied.

Article 30. The following are prohibited conducts for Money Remittance Houses:

1. Careless handling of its records, files, and other documents when this impedes or hinders the inspection of its operations.

2. Failure to comply with the instructions issued by the Directorate of Financial Companies of the Ministry of Commerce and Industries.

3. Submission of information that does not conform to the company's reality.

4. False declarations, duly verified to the Directorate of Financial Companies of the Ministry of Commerce and Industries, by directors, officers, representatives, managers, and other officials, regarding the operations or business of the company.

5. Misrepresenting the information referred to in Article 18 of this Law.

6. Failure to know the place of origin and destination of the funds that it remits.

7. Carrying out any other act or conduct in violation of this Law.

Article 31. Whenever knowledge or well-founded reasons indicate that a natural or juridical person is habitually exercising the business of Money Remittance House, without the authorization issued by the Directorate of Financial Companies of the Ministry of Commerce and Industries, the latter shall have the power to examine its books, accounting records, accounts and other documents that may be pertinent and necessary, to determine the fact.

Any unjustified failure to submit such books, accounting records, accounts, and other necessary and pertinent documents shall be sanctioned by the Directorate of Financial Companies of the Ministry of Commerce and Industries, with a fine of up to twenty-five thousand balboas (B/.25,000.00), using a duly motivated resolution.

If, after imposing the sanction mentioned in the preceding paragraph, the refusal persists, then it shall be presumed that said natural or juridical person is operating without authorization.

Article 32. The Directorate of Financial Companies of the Ministry of Commerce and Industries may intervene, after inspection, in the establishments in which it is presumed that the Money Remittance House business is being conducted without due authorization and, if such fact is proven, shall impose a fine of one hundred thousand balboas (B/.100,000.00) and shall request the General Directorate of Domestic Commerce, through a reasoned resolution, the cancellation of the license or commercial registration of the establishment.

The Directorate of Financial Companies will send a duly authenticated copy of the resolution issued by the General Directorate of Domestic Trade, which cancels the commercial license or registration, to the Ministry of Economy and Finance and the corresponding mayor's office that they may carry out the appropriate procedures.

The Directorate of Financial Companies will order the immediate closure of the establishments in which it has been identified that the money remittance house business is being carried out without due authorization, to count on the assistance of the National Police…."

To avoid non-compliance with the obligations and possible infractions, the Ministry of Commerce and Industries and the Financial Analysis Unit have provided users with various instruments, including the manual that we proceed to transcribe, which is attached as a link at the end of this document.

BEST PRACTICES FOR FILING A SUSPICIOUS TRANSACTION REPORT (ROS) IN THE REMITTANCE SECTOR.

INTRODUCTION

The Financial Analysis Unit (UAF) of the Republic of Panama is the national center for the collection and analysis of financial information related to the crimes of money laundering, financing of terrorism, and financing the proliferation of weapons of mass destruction, as well as for the communication of the results of that analysis to the country's investigative and law enforcement authorities, as established in Article 9 of Law 23 of April 27, 2015.

The UAF received the information from Financial and Non-Financial Regulated Entities through Suspicious Transaction Reports (ROS), according to the content of Article 54 of the same Law, as amended by Law 70 of January 31, 2019.

The reports received go through a mixed process of prioritization (objective and subjective) to be complemented with other types of information obtained from internal and external sources to add value to the ROS and to find elements that allow broadening the elements of suspicion and in that case refer to the various competent authorities authorized by law, information on financial transactions and other information deemed applicable to prevent the crimes of money laundering and financing of terrorism and proliferation of weapons of mass destruction, as provided for in the regulations in force, for its appropriate use as financial intelligence information. It is essential to point out that when no elements are found that allow expanding the elements of suspicion concerning the link of the persons, facts, transactions and/or operations with these crimes, the proceedings are filed until new elements are obtained that allow advance or continue with the analysis of the report.

Upon receipt of a ROS at the UAF and following the powers contemplated in Article 11 of Law 23 of 2015, the UAF is an entity that performs Operational and Strategic analysis but does not have investigative functions, so the reports received are stored in a database always waiting to expand the elements initially received spontaneously and according to the requirements of the competent authorities and authorized by law, through the Technical Assistance that in turn allow the prioritization of such reports.

Operational analysis in generating financial intelligence consists of adding value to the data obtained from regulated entities and other sources to convert it into useful information for the competent authorities.

The content of the ROS (filling out, description, and supporting documents) constitutes the raw material that initiates the financial intelligence process. For this reason, the reports must have specific characteristics so that the product generated from this process (financial intelligence report) is helpful for the competent authorities of the Public Prosecutor's Office, State Intelligence and Security Entities, and the National Customs Authority.

This document has been prepared by the Strategic Analysis Section based on the analysis of the information received, allowing us to issue the following recommendations to prepare better Suspicious Transaction Reports.

The main objective of this best practices manual is to provide feedback to the regulated entities in a sectorized manner in the presentation of better Suspicious Transaction Reports, proposing that the content of the same allows the Financial Analysis Unit to prioritize and analyze the information received.

Another essential objective is to allow the different sectors to access the manual of best practices for ROS submission in a segmented manner, thus ensuring that, if they follow the recommendations and guidelines contained herein, their Report will meet the minimum requirements for it to be received and submitted to the appropriate prioritization process.

SECTORAL REGULATORY FRAMEWORK

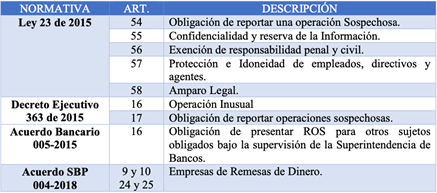

REGULATIONS ASSOCIATED WITH THE SUBMISSION OF SUSPICIOUS TRANSACTION REPORTS (ROS) FROM THE REMITTANCE SECTOR TO THE UAF.

PROCEDURE FOR SENDING INFORMATION THROUGH THE “UAF ONLINE” PLATFORM.

The virtual suspicious transaction report form (UAF-SOS), which is completed through the “UAF Online” technological platform, consists of 6 parts, which are described in detail in the filling instructions, as well as in the manual for capturing new ROSs, both of which can be found in the manuals section of the UAF website. (www.uaf.gob.pa).

PRINCIPLES FOR THE PREPARATION OF REPORTS

In the reports, the UAF expects to obtain information to answer the following questions: Who?, What?, When?, How?, Where? For what? Why? related to the persons involved in the reported transactions, the financial products used and/or services offered, the date on which the transactions were carried out, the justifications provided by the client, and the specific reasons that led the regulated entity to file the ROS.

When sending a ROS to the UAF, regulated entities must ensure that it contains the required information to respond to previously raised questions.

Principle of Integrity

A ROS must be complete. This means that regulated entities must include all data obtained on the persons involved in the report, the specific dates of the transactions and/or operations, the amounts, the financial products and/or services used, the precise characteristics of the confirmed (suspected) unusuality, as well as the reasons for the report.

Principle of Accuracy

Reports must be accurate. This implies that the ROS must result from monitoring, expansion, request for information, and analysis with a degree of depth. It is possible to confirm the unusual elements that make it escalate to a suspicious operation susceptible to being reported to the UAF.

Principle of Timeliness

A report is expected to be timely, i.e., at the time it is submitted, the UAF should be able to take preventive measures, informing the competent authorities, to avoid either the execution of an operation, immobilize assets that could be linked to any criminal activity and/or achieve the apprehension of such assets. However, in some circumstances, the timeliness of the report may not relate to the time at which the transactions took place but instead to the time at which the institution obtained information that led it to classify the customer and/or his transactions as suspicious.

CONSIDERATIONS TO BE TAKEN INTO ACCOUNT FOR THE PREPARATION OF REPORTS.

Objective and Subjective Aspects to include in the Reports

Objective Aspects

- In the reporting form, the regulated entity must complete the data regarding the persons involved and the profile of the reported transaction, which do not imply a value judgment on the characteristics of the reported situation or the reasons for which the report is filed (completeness of the ROS form).

- At least the following data detailed in the respective ROS forms must be accurately included concerning the persons directly and indirectly related to the situation reported:

- Country of the document.

- Type of document.

- Document number.

- Full name / Company name.

- Nationalities / Country of incorporation.

- Declared activity.

- Country where the main activities are carried out.

- Type of link to the reported account, transaction, and/or service. Additional observations to add to the report. Additionally, information should include, in an accurate manner, at least the following data concerning the profile of the reported operation:

- Date or period in which the reported transactions took place. The geographic area involved (In Panama or abroad).

- Country.

- Province.

- Type of product or financial transaction involved.

- Type of service used.

- Approximate amount.

- Indicate if there is an account involved and identify the numbers.

- Economic activities are carried out.

Subjective Aspects

- The regulated entities must disclose in the report the elements considered concerning the assessment made to choose the characteristics of the reported transaction, as well as the description of the elements that led to the classification of customers and/or activities as unusual, the steps taken to confirm them and their escalation to a suspicious transaction, which constitutes the basis for the filing of the ROS.

- Regarding the description of the reported operation, the obligated entity should:

- Relate the role of people within the operation.

- Mention the products related to the operation.

- Indicate the warning signs identified.

- Indicate the period of time in which the operations were carried out.

- Explain the place(s) where the transactions took place.

- State the tasks carried out by the Compliance Officer and/or Liaison that finally led to reporting the operation.

- Mention if direct inquiries were made with the client or if additional information was requested.

- Ensure that the description is structured in an orderly, chronological manner and with a reasonable level of detail.

- Clearly explain the reasons why the reporting entity is submitting the report.

- Ensure that, if there is attached information, it is provided in an orderly manner and clearly details the content of the data.

Disclaimers and Waivers for the Sending of the ROS

It is essential to clarify to the Regulated Entity that the fact that it states that it has identified suspicious operations on the part of its client is not indicative, nor shall it be understood as a denunciation or accusation that directly or indirectly links its client to a crime of Money Laundering, Financing of Terrorism and Financing of the Proliferation of Weapons of Mass Destruction or crimes precedent thereto, for which reason said report shall be received and reviewed following the provisions of articles 54, 55 and 56 of Law 23 of April 27, 2015, and its corresponding amendments.

Having made this clarification, it is crucial that the regulated entity is not afraid to describe the tangible aspects that motivate the filing of a suspicious transaction report, the greater clarity and elements that the regulated entity can provide at the time of submitting the "ROS" will significantly contribute to the quality of such report.

The regulated entity should avoid making reports for negative news reviews without making any statement regarding the identification or not of suspicious transactions within the operation, transaction, and/or service used.

Promptness in the Sending of the ROS:

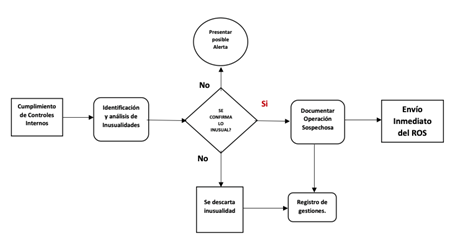

If once the steps for confirmation and/or discarding of the Unusual Transaction have been carried out, the transaction is confirmed, then it is from this moment on that the ROS must be immediately reported to the UAF.

This means that the regulated entity must have within its internal controls a reasonable period of time to rule out and/or confirm the unusual operation, which allows it to comfortably submit an immediate ROS at the moment of the confirmation of such operation escalated to suspicious.

The following outlines the minimum process that regulated entities must carry out before immediately identifying and sending a Suspicious Transaction Report (ROS) to the UAF.

SUPPORTING DOCUMENTATION

An essential element that affects the quality of a Suspicious Transaction Report (ROS) is the supporting documentation that allows the Financial Analysis Unit (UAF) to analyze the submitted report fluently.

It is essential to point out that a good description of the reason for the Suspicious Transaction Report "ROS" without documentation that allows the analysis of such report will not allow an adequate assessment of the same, thus negatively affecting its quality.

The supporting documentation for the facts, transactions, and/or operations executed by clients will depend to a great extent on the type of regulated entity or sector in question. In this sense, the documents expected to be received from the "Financial Sector" differ too much from the supporting documents needed to analyze reports from the "Non-Financial Sector" (APNFDs).

By the above, a list of minimum documents that must be provided as supporting documentation for the Suspicious Transaction Reports (ROS) is presented. In this sense, the Regulated Entities should feel free to send all the documentation that they wish to include as support without ignoring or excluding the sending of the information that is required as a minimum for the "ROS" to be appropriately assessed and allow its analysis by the Financial Analysis Unit (UAF).

To comply with the above, this ROS Quality Manual includes a ROS Support Documentation Guide, which will assist regulated entities in improving the quality of the reports they send to the UAF.

There are several regulations available to remittance houses on the UAF website and those of the Ministry of Commerce and Industry, which are available on the following websites.

FINANCIAL ANALYSIS UNIT

- Guide for the timely generation and dispatch of warnings - https://www.uaf.gob.pa/tmp/file/510/Guia%20para%20la%20Generacion%20y%20envio%20oportuno%20de%20alertasV2.pdf

- Warning Signs Guide - https://www.uaf.gob.pa/tmp/file/483/Catalogos%20de%20señales%20de%20alertas.pdf

- Guide for ROSs of Possible Tax Fraud - https://www.uaf.gob.pa/tmp/file/446/Guia%20def%20fiscal.pdf

- General ROS Quality Guide - https://www.uaf.gob.pa/tmp/file/358/Guia%20Calidad%20de%20ROS%20(General).pdf

- UAF Online ROS Follow-up Manual - https://www.uaf.gob.pa/tmp/file/385/GUIA%20MANUAL%20DE%20SEGUIMIENTO%20DEL%20ROS%20EN%20UAFEL.pdf

- Best Practices Manual on Suspicious Transactions - Remittances Sector - https://www.uaf.gob.pa/tmp/file/380/MANUAL%20ROS-SECTOR%20REMESAS.pdf

MINISTRY OF TRADE AND INDUSTRY

- Guide to remittance houses - https://mici.gob.pa/uploads/media_ficheros/2022/02/2/guia-no-3-requisitos-casa-de-remesas-de-dinero.pdf

NATIONAL LEGISLATION

- Regulation of Money Remittance House Operations - https://www.superbancos.gob.pa/superbancos/documentos/prevencion_op_il/regimen_antilavado/leyes/Ley48.pdf

Related